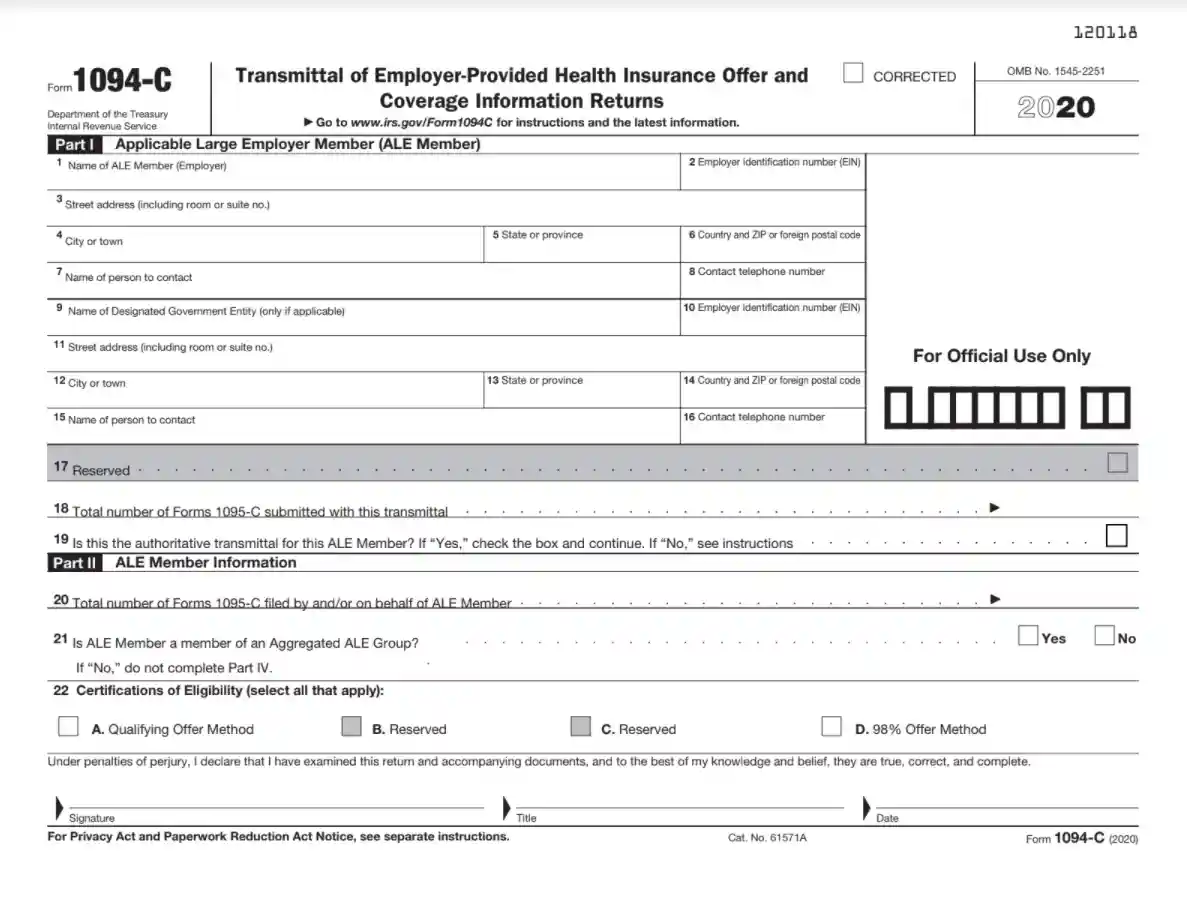

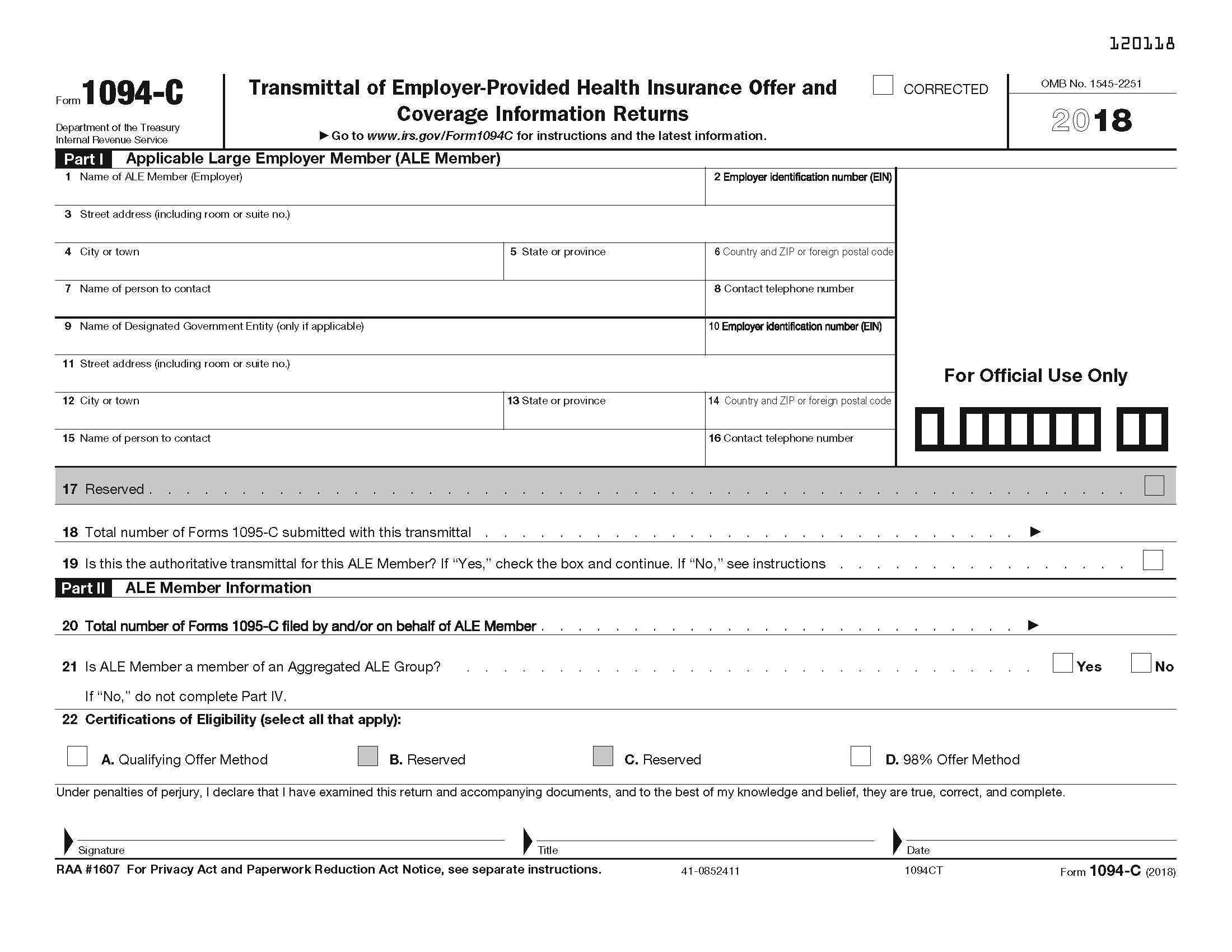

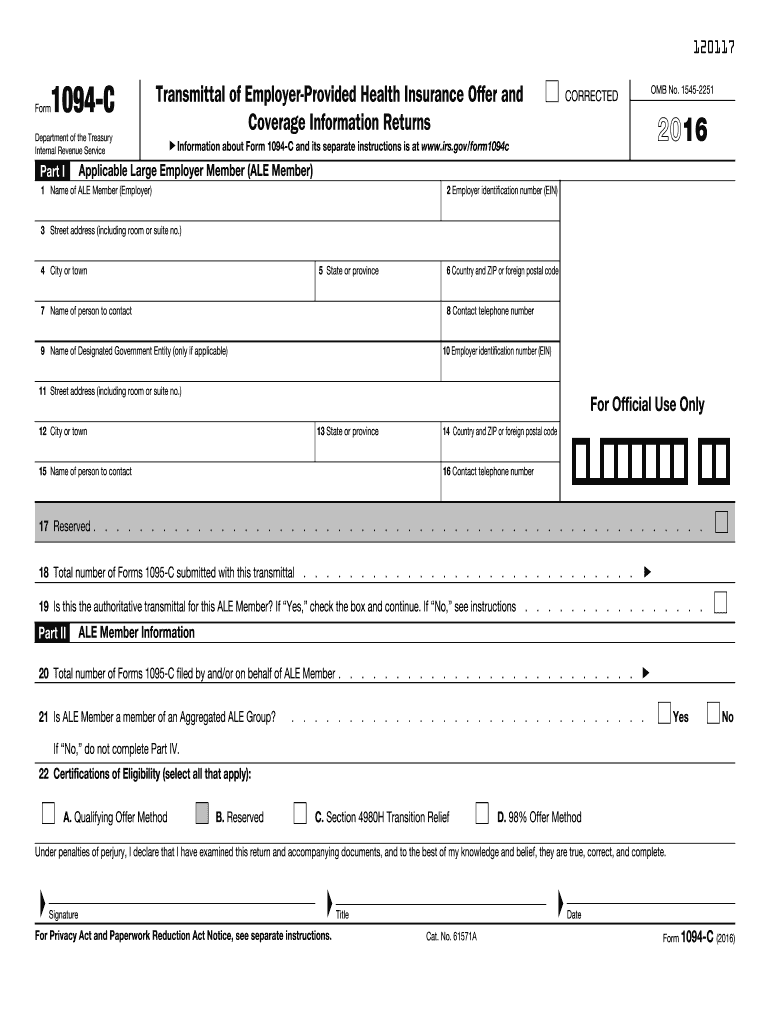

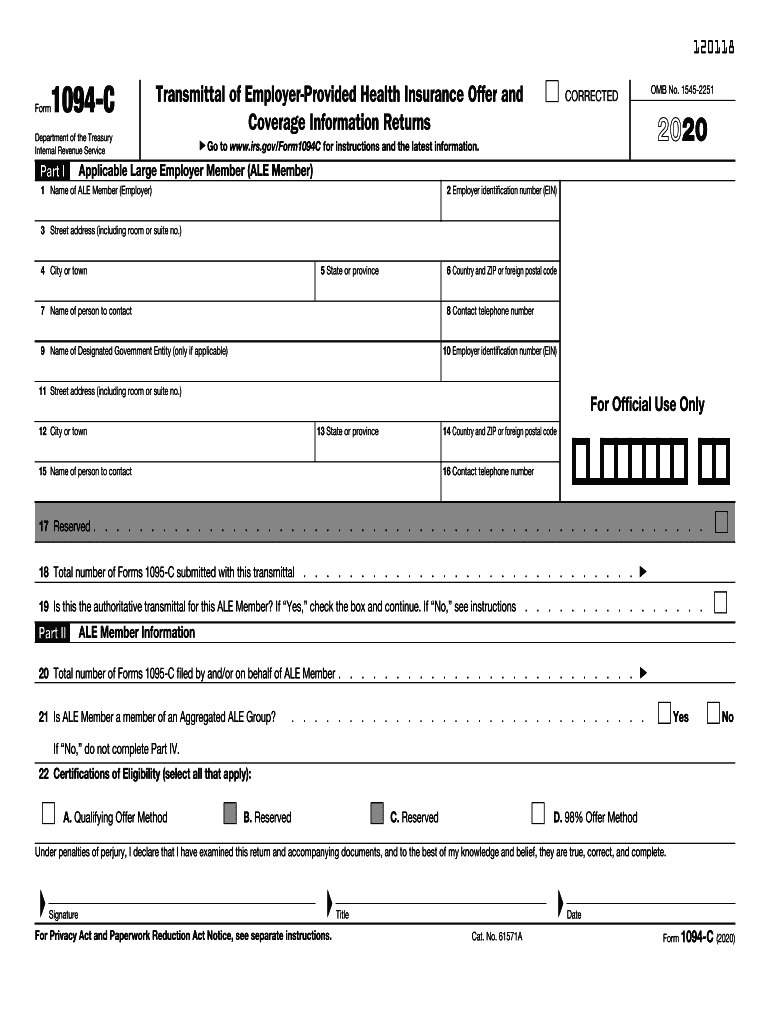

A Form 1094C must be filed when an employer files one or more Forms 1095C An employer may choose to file multiple Forms 1094C, accompanied by Forms 1095C for some of its employees, provided that a Form 1095C is filed for each employee for whom the employer is required to fileForm 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Return Filing is optional for CY 14, but required for Coverage Years starting in 15 All Applicable Large Employer (ALE) Members are required to file Forms 1094C and 1095C for Coverage Years starting in 16What is Form 1094C?

1

1094 concord parkway n

1094 concord parkway n- Applicable large employers (ALEs) that submitted Forms 1094C and 1095C should correct any errors as soon as possible to avoid possible penalties All ALEs are required to use these forms to report information about group health coverage, regardless of whether they "play or pay" in accordance with the Affordable Care Act's Employer Shared Responsibility provisions All Applicable Large Employers (ALE) and members of ALE Aggregate Groups must file a 1094C and Forms 1095 C for eligible employees Every employer and ALE member must file an authoritative transmittal

New Instructions For Forms 1094 C And 1095 C An Infographic The Aca Times

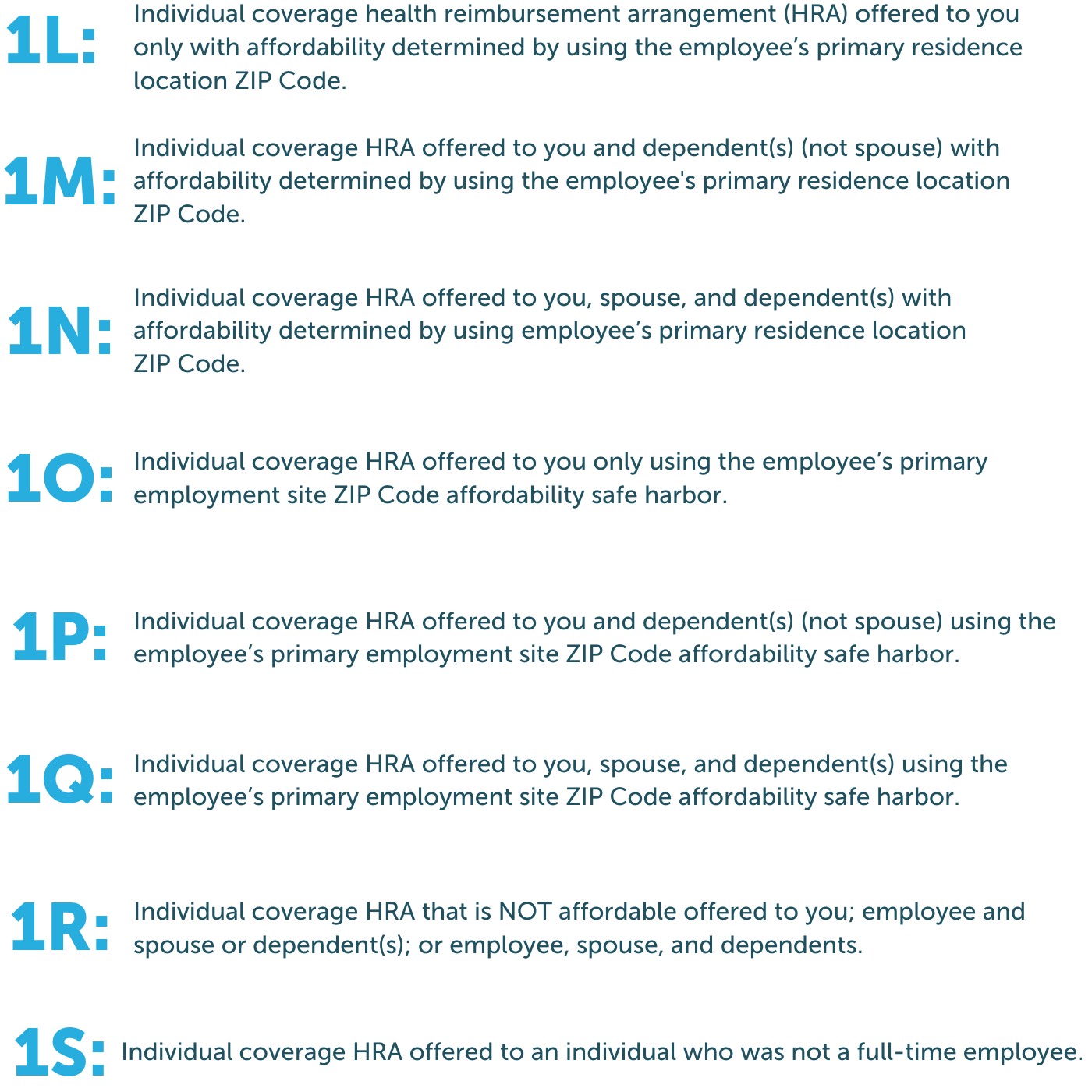

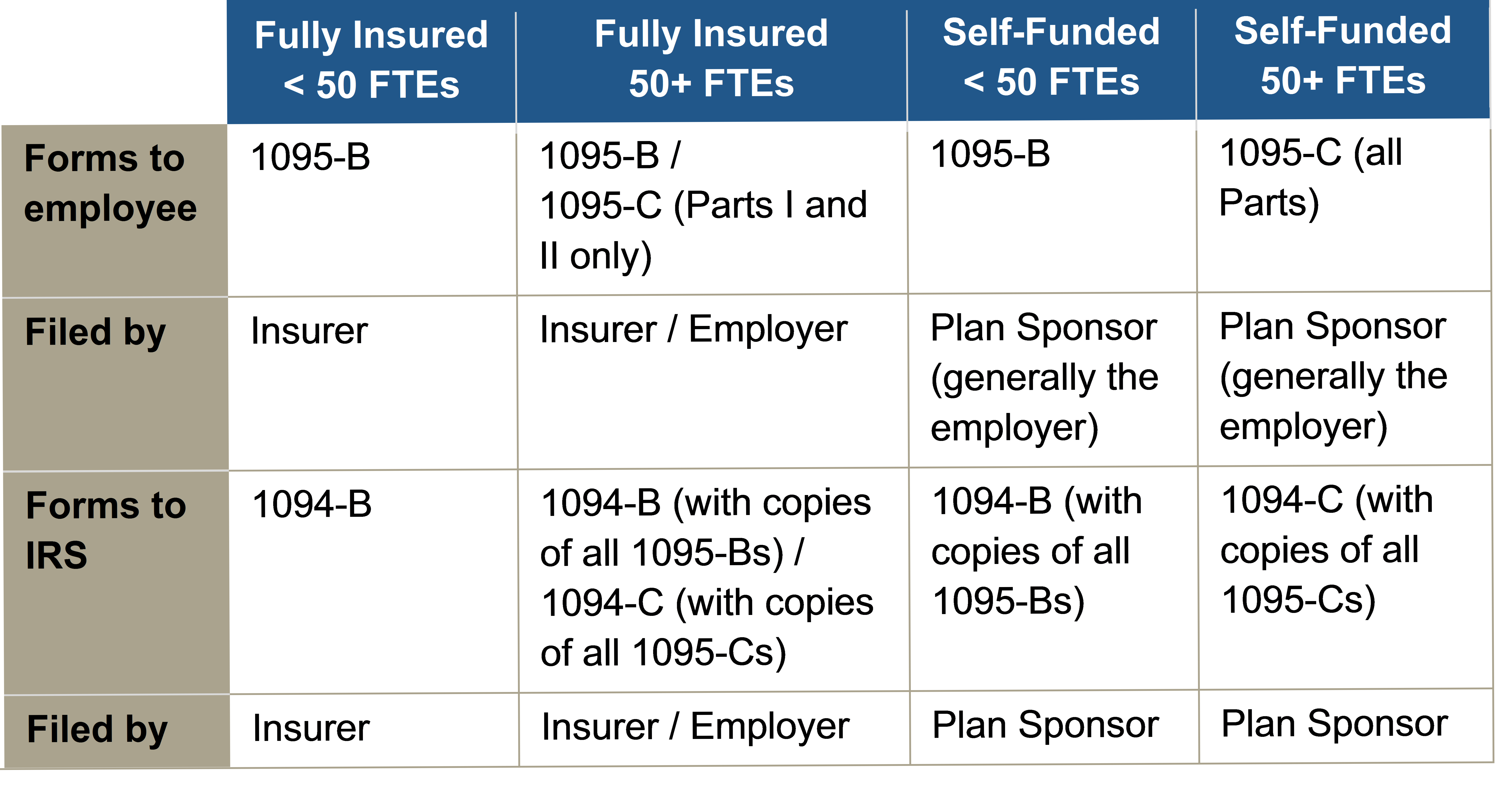

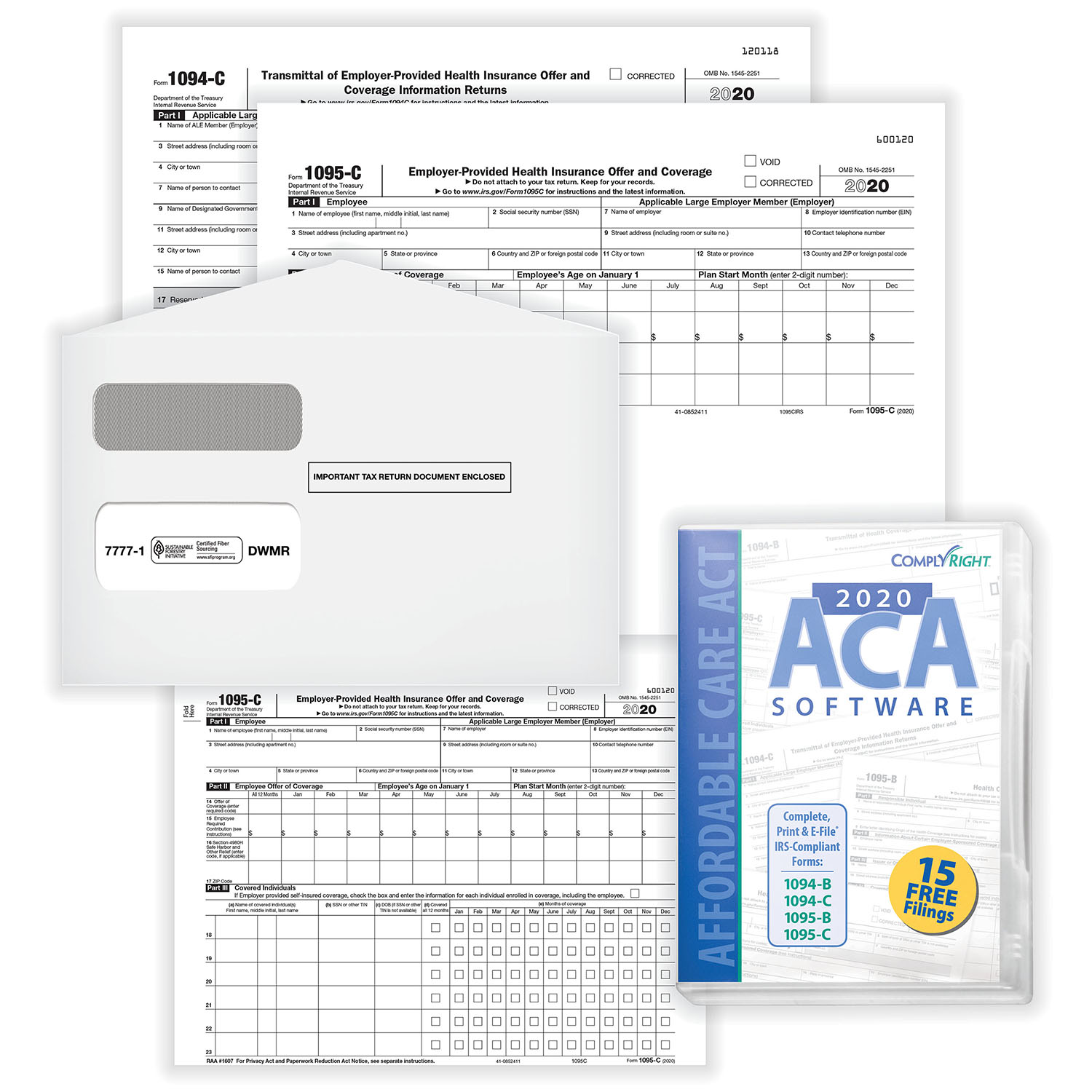

You will need to provide and file the proper Form 1095 based on the model above that meets your company's specifics It's also important to note that Forms 1095B/C need to be filed with the IRS and require a matching Form 1094 You can learn more about the specifics for filing 1094B and 1095B here and 1094C and 1095C here Form 1094C is a requirement for Applicable Large Employers (ALE), or those with 50 or more fulltime equivalent employees Who is responsible Form 1094B will be completed by the carrier or plan sponsor Form 1094C is completed by the employer or members of the Applicable Large Employer (ALE) Form 1095Form 1094C and Form 1095C are IRS forms that employers must file if they are required to offer their employees health insurance under the Affordable Care Act (ACA) The primary difference between these two forms is that Form 1095C includes health insurance information and is provided to the IRS and employees

Employers will file copies of Forms 1095C with transmittal Form 1094C to the IRS The employer will indicate on Form 1094C if it is eligible for alternative (simplified) reporting Employers also will use this form to certify that the employer is eligible for transition relief under the ACA "play or pay" rules, if applicableForm 1094C and Form 1095C are forms used to report required information about healthcare to the IRS Following the Affordable Care Act (ACA), all applicable large employers (ALEs) need to report whether they've offered health coverage to each employee and whether those employees are enrolled in health coverageForm 1094C Part IVOther ALE Members of Aggregated ALE Group 3 Enter the names and EINs of Other ALE Members of the Aggregated ALE Group (who were members at any time during the calendar year) Form 1094C

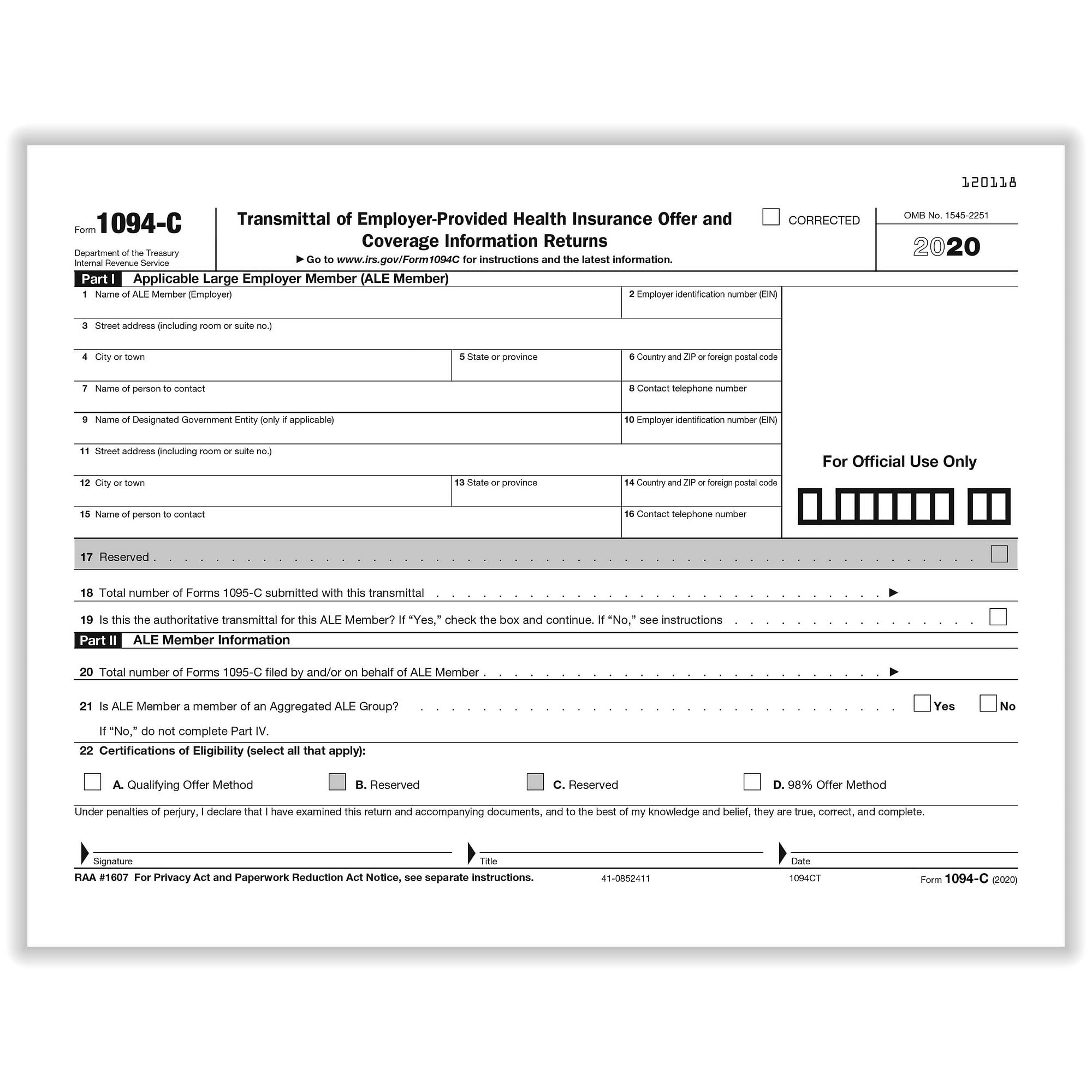

Form 1094C is a transmittal to the IRS that, in combination with Form 1095C providing individualized information, satisfies these requirements In addition, ALEs sponsoring selfinsured health plans must report enrollment information to the IRS For employees, this information is reported on Part III of Form 1095C Form 1094C summarizes the ALE's 1095C information returns as well as details pertaining to the organization, such as EIN, address, point of contact, and certifications of eligibility regarding the health insurance offered for a particular year Specifically, Form 1094C1094C is the transmittal form that accompanies Form 1095C when filing with the IRS each year Together, Forms 1094C and 1095C are used to provide information to the IRS regarding health insurance coverage offered to your fulltime employees and that status of individual employee's enrollment

2

Peia Wv Gov Forms Downloads Documents Other Documents Benefit Coordinators Aca Reporting Pdf

Overview of Form 1094C Form 1094C is the transmittal form that accompanies Form 1095C when filing with the IRS each year Together, Forms 1094C and 1095C are used to provide information to the IRS regarding health insurance coverage offered to your fulltime employees and that status of individual employee's enrollmentComplete lines 22 only if this 1094C is the Authoritative Transmittal This number should match line 18 if this is the only 1094C form being submitted for the employer If you are filing multiple 1094Cs then this line should reflect the sum of all 1095Cs being filed with all 1094Cs for this ALE member 21Form 1094C, called "Transmittal of EmployerProvided Health Insurance Offer and Coverage," is a cover sheet that employers must send to the IRS along with each 1095C form The 1094C form asks for aggregate employerlevel data When Do the Forms Need to be Filed?

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

2

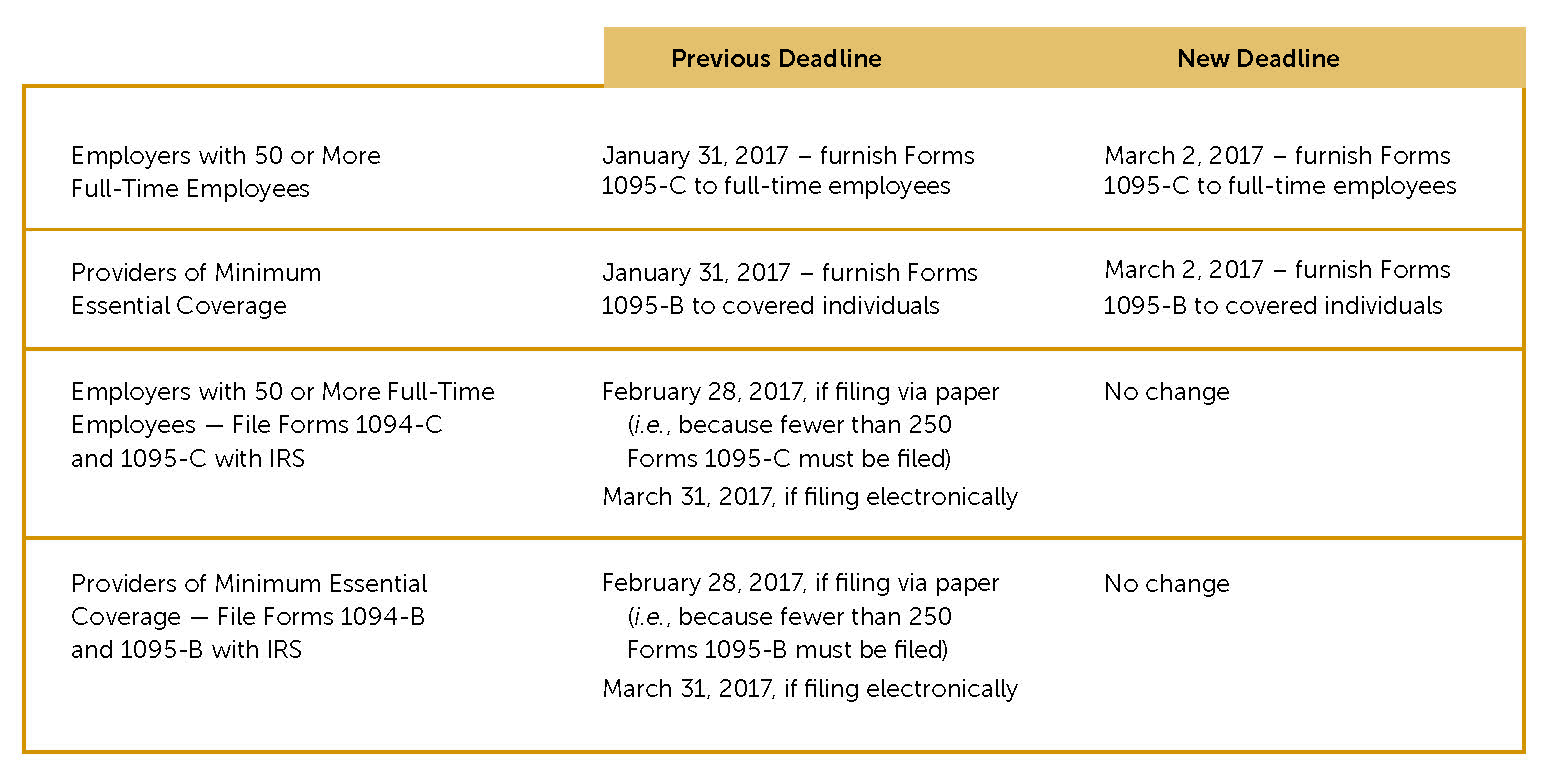

Form 1094C is a transmittal to the IRS that, in combination with Form 1095C providing individualized information, satisfies these requirements Form 1095C is furnished to individuals, but Form 1094C is not There are separate deadlines for filing forms with the IRS and furnishing statements to individuals The 1094C must be filed with the Form 1095C, but it acts as a sort of cover sheet that sums up all the 1095Cs As stated above, the primary goal for the IRS with these forms is to determine whether you have satisfied the Employer Mandate, whereby you offer sufficient insurance If you don't satisfy the Employer Mandate, there are fines Forms 1094C and 1095C are required to be completed all employers with 50 or more full time equivalent employees This must be filed by any employer subject to the employer mandate Form 1094C is the Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns

3

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Over the past six months many employers have received notifications from the IRS that they have failed to file the Forms 1094C and 1095C with the IRS This type of noncompliance is often due to the employer failing to file a Form 1094C for each Applicable Large Employer (ALE) member The instructions to the Form 1094C are clear that each ALE member must file a Form The 1094C must be filed with the Form 1095C, but it acts as a sort of cover sheet that sums up all the 1095Cs As stated above, the primary goal for the IRS with these forms is to determine whether you have satisfied the Employer Mandate, whereby youMany employers working to accomplish Affordable Care Act (ACA) reporting are puzzled by Line 22 on Form 1094C That line asks the employer whether it has used the "Qualifying Offer Method" or the "98% Offer Method"

Filing Form 1094 C Youtube

1095 C Reporting Determining A Company S Ale Status Integrity Data

Form 1094C is a coversheet that must accompany every Form 1095C a reporting employer sends to the IRS 36 37 If you find yourself sending a Form 1094C, without attaching Forms 1095C, to the IRS, you are doing it wrong 37 38Form 1094C Form 1094C is used in combination with Form 1095C to determine employer shared responsibility penalties It is often referred to as the "transmittal form" or "cover sheet" IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement, which relates to the employer shared responsibility/play or pay Forms 1094C Federal instructions regarding Authoritative Transmittal are not applicable for California purposes Information on federal Form 1094C, line 19, is not required by the FTB When To File You will meet the requirement to file federal Forms 1094C and 1095C if the forms are properly addressed and mailed on or before the

2

Http Www Psfinc Com Hcr Files Agwebinarseries 10 26 17 Pdf

Forms 1095B, 1094C and 1095C need to be corrected if they include incorrect information The form 1094B Transmittal does not allow for corrections Form 1094B is merely a transmittal document In addition, the form 1094C that is not the authoritative transmittal doesDo Employers Need to Send Both Forms to the IRS and Their Employees?1094 C 1094C is one of the IRS forms filed by employers (along with Form 1095C) Any business owner with employees must submit these forms when they are required to offer employees health insurance coverage under Obamacare, also referred to as the Affordable Care ActThe 1095C contains a wealth of information regarding health insurance

Bernieportal Start The New Year Off Right By Registering For Our Brand New Bernieu Course Intro To Forms 1094 C And 1095 C Now Live Our Bernieu Courses Are Free And Provide

1094 C Transmittal Of Employer Provided Health Insurance 1095c Coverage Info Returns 3 Sheets Form 100 Forms Pack

Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095COur services include the printing and mailing of form 1095C and 1095B and efiling with the IRS using their new AIR filing system With our 1095 and 1094 reporting services, you do not have to worry about purchasing software or annual renewals We help businesses focus on their core competency while we take care of their information reporting 1094C, and another division of the employer (eg, the headquarters) is submitting the "Authoritative" transmittal for all divisions (with the same EIN) of the employer If this division is not filing the "Authoritative" transmittal of the 1094C on behalf of the entire employer, this division would leave lines 1922 blank

3

1094 C Transmittal Of Employer Provided Health Insurance 1095c Coverage Info Returns 3 Sheets Form 100 Forms Pack

The 1094C form is not considered a correction by the IRS if it is being submitted as the cover page for one or more corrected 1095C forms The accompanying 1094C form is simply a new form and the data on it should reflect what is being submitted with it (eg, if 1 form needs correcting, Line 18 on the 1094 form will state "1" evenWhat Is Form 1094C?Note that substitute forms may be used, but the substitute forms must include all of the information required by Forms 1094C and 1095C and must satisfy all of the IRS's form and content requirements Forms 1094B and 1095B are to be used by a small selfinsured employer that is not an ALE for Section 6055 purposes

Training Tutorials Submitting Aca 1094 C And 1095 C Forms Electronically On Vimeo

Form 1095 C Health Coverage And Envelopes With Aca Software Includes 3 1094 B Transmittal Forms Pack Of 0 Forms Amazon In Office Products

(c) of Part III of Form 1094 C • Form Instructions(Page 9) Confirm employee personal data is available • Employee legal name, social security number, mailing address 3 Determine who is a fulltime employee Confirm whether you are using the monthly method or look back method to measure hours of service for full time status Form 1094C contains information about the ALE, and is how an employer identifies as being part of a controlled group It also has a section labeled "Certifications of Eligibility" and instructs employers to "select all that apply" with four boxes that can be checked The section is often referred to as the "Line 22" question or boxes IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare

New Instructions For Forms 1094 C And 1095 C An Infographic The Aca Times

Office Depot

If you check Box C, you must also complete Part III, column (e) of Form 1094C, Section 4980H Transition Relief Indicator D 98% Offer Method Check this box if you're eligible for and using the 98% Offer MethodForm 1094C Form 1094C is used in combination with Form 1095C to determine employer shared responsibility penalties It is often referred to as the "transmittal form" or "cover sheet" IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement, which relates to the employer shared responsibility/play or payForm 1094C will transmit forms 1095C to the IRS Forms 1094C and 1095C will be used to determine whether an employer will be penalized for noncompliance This penalty will require payment under the Employer Shared Responsibility provisions under section 4980H These forms will also determine employees' eligibility for the premium tax credit

Irs Releases Draft Copies Of Forms 1094 C And 1095 C Health E Fx

Www Americaninsuranceid Com Faq Blog 3492 Aca Employerreportingrequirements 15 Pdf

1094C 1095C ACA Compliance ACA Individual Mandate ACA Penalties ACA Reporting Affordable Care Act Congress DC 1094/1095 Filing Health Care Coverage Minimum Essential Coverage (MEC) MyTaxDC Office of Tax and Revenue (OTR) Washington DCAn IRS AIR TCC is required to file information returns 1094B, 1095B, 1094C and/or 1095C See the Account Ability Help menu for instructions on how to apply for an ACA TCC ("Application for ACA TCC Instructions")Form 1094C is the transmittal form that accompanies the employer's Forms 1095C submitted to the IRS But in addition to serving as a transmittal form, like a W3, the employer also uses Form 1094C to demonstrate compliance with the "95 percent"

1

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

The IRS has clarified the proper method for completing IRS Form 1094C on behalf of a controlled group IRS Form 1094C is the transmittal form for IRS Forms 1095CApplicable Large Employers subject to The Affordable Care Act's reporting requirements are required to submit their IRS Form 1094Cs and 1095Cs to the IRS by if filing on paper, and by June 30, Common Mistakes in Completing Forms 1094C and 1095C By now, most applicable large employers (ALEs) are very familiar with the reporting requirements under the ACA Yet we often see the same mistakes when these employers complete Forms 1094C and 1095C The confusion is understandable, given the backandforth with ACA implementation Company B completes its Form 1094C as the Authoritative Transmittal as follows Part I Include Company B's identifying information and check the box in Line 19 indicating this is the Authoritative Transmittal Part II Report information about Company B as an employer In Line 21 – "is the ALE member a member of an Aggregated ALE Group

Www Ftb Ca Gov Forms 35c Publication Pdf

2

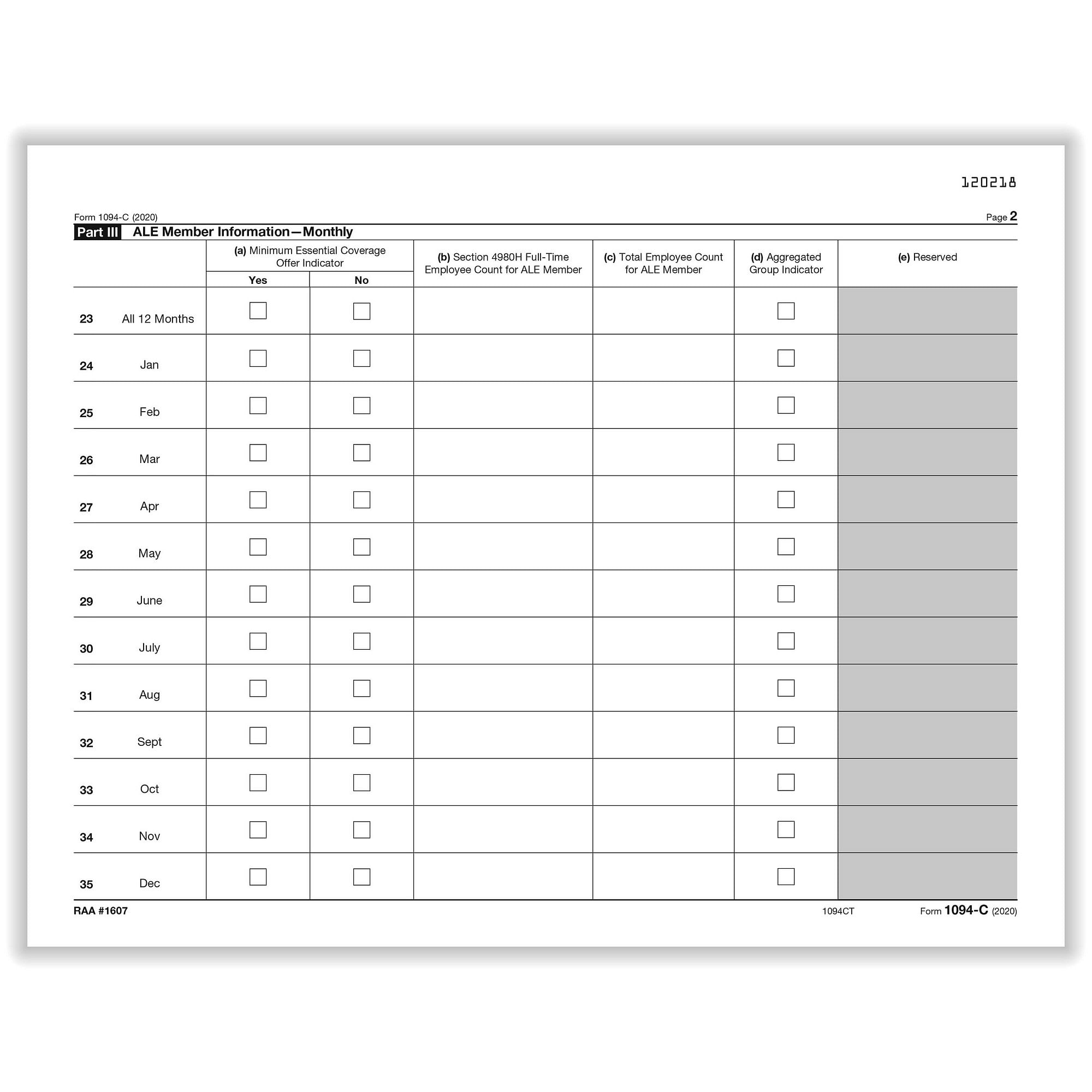

To file 1094C corrections, send the updated form by itself Nothing else can go with this form On the correct form, mark the "corrected" box with an "X" For specific cases and how to deal with them, consult the chart on the IRS site A corrected Form 1095C must be sent along with a 1094C transmittal formForm 1094C and Form 1095C are subject to requirements to file returns electronically with the IRS This means that ALEs that file 250 or more information returns must file the returns electronically through the ACA Information Returns (AIR) program (Note that AIR is a new and separate system solely for ACA information returnsTitle Cat No A Date Form 1094C () 1218 Page 2 Form 1094C () Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes 23 No (b) Section 4980H FullTime Employee Count for ALE Member (c) Total Employee Count for ALE Member (d) Aggregated Group Indicator (e) Reserved All 12 Months 24 Jan 25

Infographic Need Help Identifying The Authoritative Transmittal Bukaty Companies

Irs Delays The Deadline To Furnish The Aca Forms 1095 C And 1095 B To March 2 17 And Extends The Good Faith Transition Relief From Reporting Penalties Trucker Huss

Prior Year Products Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing

2

Irs Form 1094 C Fill Out Printable Pdf Forms Online

3

What You Need To Know About Aca Annual Reporting Aps Payroll

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

Www Hayscompanies Com Wp Content Uploads 18 10 Here Come The 1095s Pdf

Www Irs Gov Pub Irs Prior F1094c 17 Pdf

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

1094 C Transmittal Of Employer Provided Health Insurance Forms Fulfillment

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

2

2

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

Http Download Paychex Com Pas Pbs Formfiles 1094c Alerts Pdf

2

Http Www Stellarbenefitsgroup Com Wp Content Uploads 15 06 Code Section 6056 What Information Must Be Reported Pdf

Www Bluechoicesc Com Sites Default Files Documents Agents Coco Aca agent flyers Aca reporting requirements flier Pdf

Good Sense Guide To Minimum Essential Coverage Forms 1094 C And 1095 C California Benefit Advisors Johnson Dugan

Hayward Pool Products Skimmer Lid Hayward Sp1094 Spx1094c Sp 1094 C

Transmittal Of Employer Provided Health Insurance 3 Pages Item 1094c

2

Http Cdn Complyright Com Downloadables Aca Faqs Pdf

Understanding Aca Health Coverage Information Returns Air Reporting

Http Cbplans Com Wp Content Uploads 19 12 Aca 19 Final Forms 1094 C And 1095 C Issued Pdf

Irs 1094 C 16 Fill Out Tax Template Online Us Legal Forms

How To Generate Forms 1094 C And 1095 C In Foundation Youtube

2

2

Irs Release Drafts Of Irs Forms 1094 C And 1095 C The Aca Times

Form 1094 C Instructions For Employers What You Need To Know

United Benefit Advisors Home News Article

Http Lambbarnosky Com Wp Content Uploads 15 12 Client Memo Attachment Aca Pdf

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Http Pages Thinkhr Com Rs 276 Ktw 573 Images Aca reporting requirements tip sheet Pdf

Http Www Unitedactuarial Com Research Pdf 15 09 Pdf

Form 1095 C Health Coverage And Envelopes With Aca Software Includes 3 1094 B Transmittal Forms Pack Of 0 Forms Amazon In Office Products

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

2

Forms 1094 C And 1095 C Guided Tour For Employers With Self Insured Coverage Youtube

Compliance Update Forms 1094 C And 1095 C Calcpa Health Trusted Health Plans For Cpas

Directly E File Irs Forms 1094 C 1095 C In One Click With The Integrity Data Aca Compliance Solution Learn About Software Features

U S Affordable Care Act Aca Information Reporting 16 Sap Blogs

Irs Issues Aca 18 Forms 1094 C And 1095 C Instructions And 226j For 16 The Aca Times

File Aca 1094 C 1095 C Information With Irs On Time To Avoid Penalties The Aca Times

Irs 1094 C 21 Fill Out Tax Template Online Us Legal Forms

Ez1095 Software How To Efile Correction For 1095 C

Updated Irs Reporting Requirements Babb Insurance

Www Emiia Org Writable Files Filling Out Form 1094 C 1095 C 1 26 17 Pdf

Irs Reporting Under The Affordable Care Act Bkd Llp

Irs Releases Draft 19 Aca Reporting Forms And Instructions Alera Group

Amazon Com Form 1095 C Health Coverage And Envelopes With Aca Software Includes 6 1094 B Transmittal Forms Pack For 100 Employees Office Products

Http Product Ftwilliam Com Wp Content Uploads 17 10 Kr600 Ftw 1094 1095 Sell Sheet Fnl Pdf

Employers Are You Prepared For The Dc 1094 C 1095 C Filing Requirements The Aca Times

Www Cbiz Com Linkclick Aspx Fileticket Tiiy1s9y5pg 3d Portalid 0

2

Form 1094 C And Form 1095 C B Benchmark Planning Group

Aca Software Hrdirect

2

Affordable Care Act Form 1095 C Form And Software Hrdirect

Employer Reporting Forms 1094 C And 1095 C Hays Companies

Advantage Benefits Group Compliance

2

Ez1095 Software How To E File 1095c And 1094c Correction Youtube

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

Tax Form 1094 C Transmittal Of Employer Health 1094ct Form Center

1094 C And 1095 C Reporting Youtube

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Employer Reporting Webinar Forms 1094 C 1095 C Brown Brown Insurance

Www Irs Gov Pub Irs Prior Ic 14 Pdf

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

What You Need To Know About Forms 1094 1095

2

Irs Q A About Employer Information Reporting On Form 1094 C And Form 1095 C California Benefit Advisors Johnson Dugan

Www Alliantbenefits Com Media 1345 Alert 17 11 Amended Filings In The Era Of Esr Penalties Pdf

Irs Reporting Under The Affordable Care Act Bkd Llp

Filing Aca Form 1094 C Youtube

15 Forms 1094 B 1095 B 1094 C And 1095 C Benefits Work

0 件のコメント:

コメントを投稿